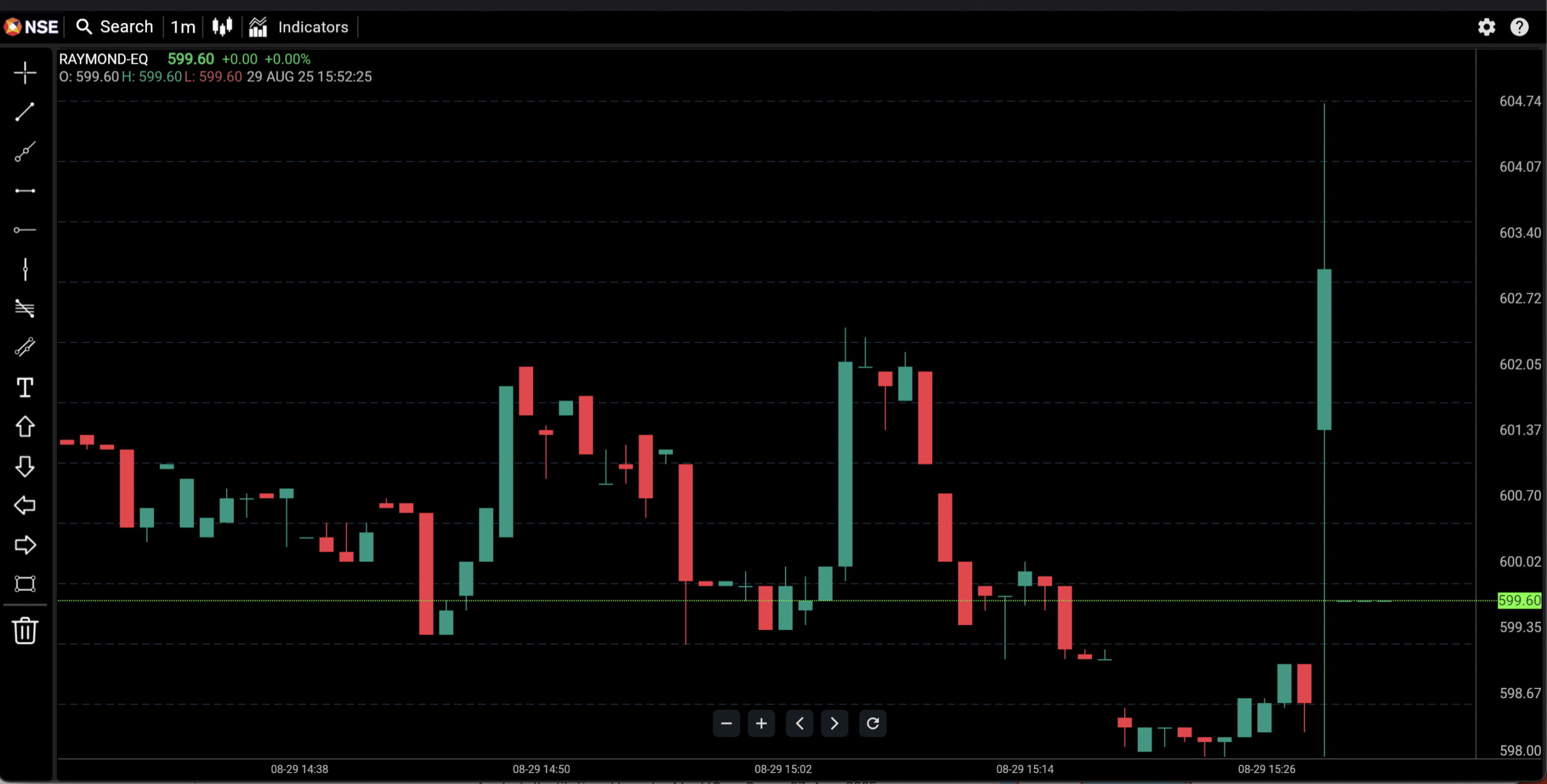

Raymond Stock Price

Raymond’s latest price move was driven by its June 2025 quarter results, which showed a sharp year-on-year decline in profits and sales—even as earnings per share (EPS) hit a record.

Key Earnings Figures (June 2025 Quarter)

- Net profit after tax fell by 24.2% year-on-year to ₹1,445.67 crore.

- Net sales dropped 22.35% YoY, coming in at ₹1,081.75 crore for the last six months.

- EPS reached ₹800.18, the highest in five quarters, but this was mainly due to an extraordinary or one-time gain rather than improved operating performance.

- Total income for Q1 FY 2025-26 was ₹555.32 crore, down 44.4% YoY from ₹998.27 crore.

- Profit after tax (PAT) was noted at ₹5328.15 crore, up 2218.7% QoQ due to exceptional gains, but down 27.7% YoY.

Market Impact

The steep decline in recurring sales and profit figures—despite a headline EPS boost—led investors to re-evaluate Raymond’s underlying operating health, triggering volatility and downward movement in the stock price. The result reflects both a challenging business environment and the impact of non-recurring income on bottom-line numbers, adding uncertainty to forecasts for sustained recovery.

Leave a Reply