Table of contents

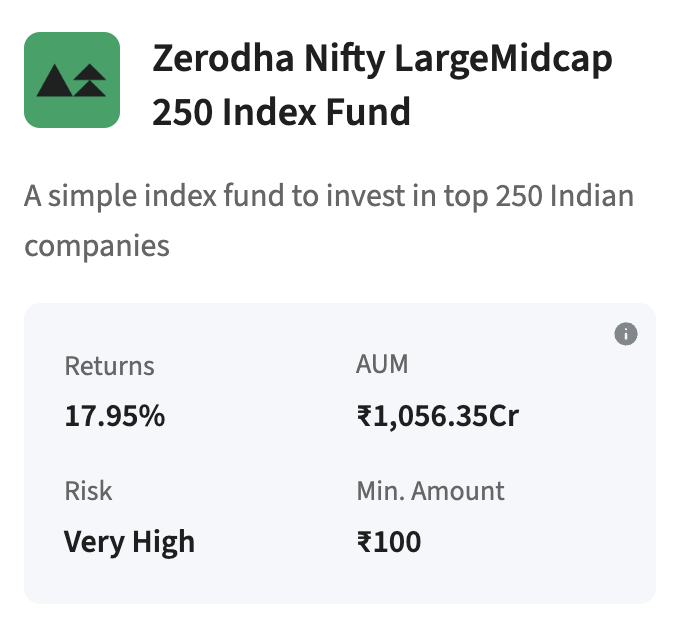

The Zerodha Nifty LargeMidcap 250 Index Fund Fund can be evaluated using several quantitative and qualitative factors including index selection, risk and return ratios, past performance, portfolio composition, costs, and suitability for one’s investment goals.

Key Evaluation Criteria

Index and Strategy

- Zerodha Midcap funds are passively managed index funds and ETFs that track indices like the Nifty Midcap 150 or Nifty LargeMidcap 250, aiming for exposure to India’s diverse mid-cap segment.

- The investment is 50% large cap and 50% mid cap (for LargeMidcap 250), with periodic rebalancing. This provides a balanced opportunity for growth, as mid caps may outperform in certain market cycles, though with higher risk.

Performance Review

- The Zerodha Nifty LargeMidcap 250 Index Fund showed an absolute return of 34.8% since inception (Nov 2023–Aug 2025), outperforming the category average annualized return.

- Recent returns are volatile with short-term dips (e.g., 1-year: -3.47%), but 6-month returns were a robust 14.78%. Midcap funds can exhibit high fluctuations over short periods.

- Risk metrics (Sharpe ratio and Sortino ratio) for comparable Zerodha funds reveal subdued risk-adjusted returns in recent market conditions: Sharpe = -0.46, Sortino = -0.05. Negative ratios suggest the fund recently underperformed relative to the risk taken.

Portfolio Composition

- The funds invest exclusively in midcap equities (for Nifty Midcap 150 variant) or balanced large-midcap equities (for the LargeMidcap 250 variant).

- Top holdings include Max Healthcare, BSE Ltd, Suzlon Energy, Dixon Technologies, etc., indicating sectoral diversification but also concentration risks typical of midcap exposures.

Risk Profile

- Classified as Very High Risk due to exposure to midcap stocks, which are more volatile and prone to larger swings than large caps.

- Standard deviation for recent returns is around 15.33, signaling considerable volatility.

Costs and Taxation

- Minimum investment is ₹100 for the index fund.

- Gains over 1 year are considered long-term and taxed at 12.5% on profits above ₹1.25L per annum for ETFs; short-term gains taxed at 20%.

Suitability

- Designed for investors with a long-term horizon, comfortable with high risk, and seeking wealth creation from India’s growth sectors.

- Portfolio is suitable for those preferring passive investing over stock selection, and who desire growth with sectoral diversification.

Comparison Table: Performance Snapshot

| Period | Fund Return | Category Avg | Benchmark Return | Fund Rank | Commentary |

| 1 Year | -3.47% | -0.46% | -3.58% | 141/229 | Below average, volatile |

| 6 Months | 14.78% | 10.75% | 14.70% | 81/303 | Strong recent rebound |

| Since Inception | 34.80% | 7.89% | — | 34/331 | Top quartile |

Final Verdict

To evaluate the Zerodha Nifty LargeMidcap assess the fund’s passive strategy, recent and historical returns, risk metrics, portfolio structure, and cost-effectiveness. This fund is best suited for long-term, high-risk investors seeking Indian midcap growth, with careful attention to volatility and cyclicality.

Leave a Reply