Category: Investments

-

Understanding economic trends in 2025 is essential for investors, policymakers, businesses, and ordinary citizens seeking to adapt and thrive amid rapid global change. The year 2025 marks a pivotal moment, shaped by shifting geopolitical dynamics, technological innovation, climate adaptation, and evolving consumer patterns. Here’s a comprehensive look at the key trends and drivers expected to…

-

Investing in mutual funds is one of the smartest ways to grow wealth and meet financial goals. Among the various categories of mutual funds, liquid funds hold a special place, especially for investors seeking low-risk, highly liquid, and flexible investment options. This tutorial will provide a clear, step-by-step understanding of what liquid funds are, how…

-

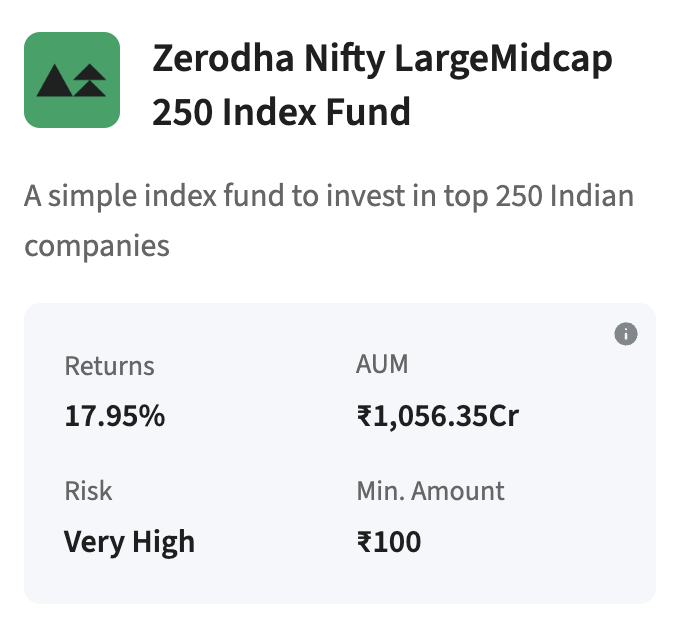

The Zerodha Nifty LargeMidcap 250 Index Fund Fund can be evaluated using several quantitative and qualitative factors including index selection, risk and return ratios, past performance, portfolio composition, costs, and suitability for one’s investment goals. Key Evaluation Criteria Index and Strategy Performance Review Portfolio Composition Risk Profile Costs and Taxation Suitability Comparison Table: Performance Snapshot…

-

Introduction EPS (Earnings Per Share) and PAT (Profit After Tax) are closely related metrics, but they serve different purposes in gauging a company’s financial health. PAT forms the basis for calculating EPS, and any change in PAT tends to directly influence EPS—provided the number of shares remains unchanged. What is PAT and EPS? The Direct…

-

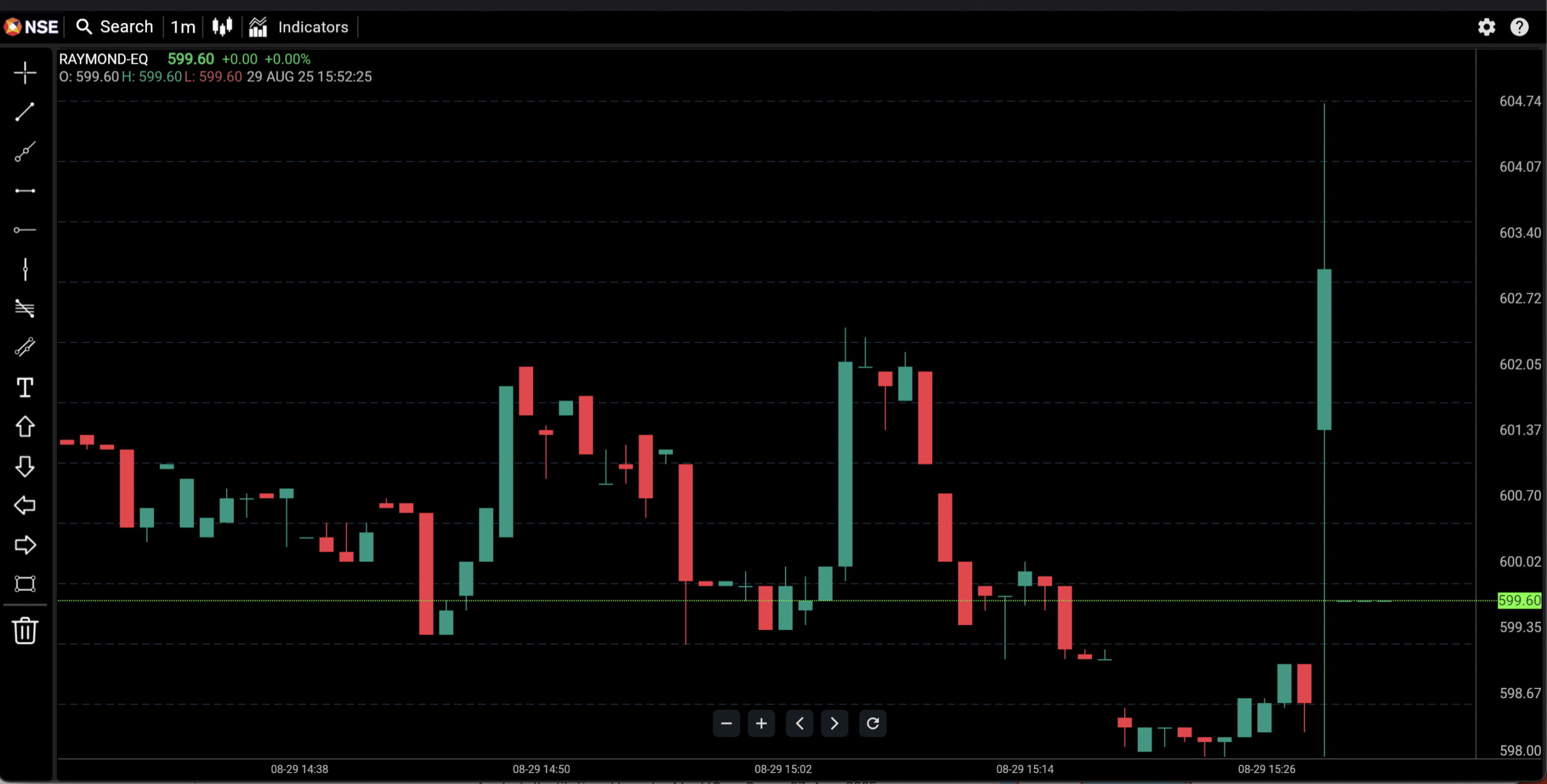

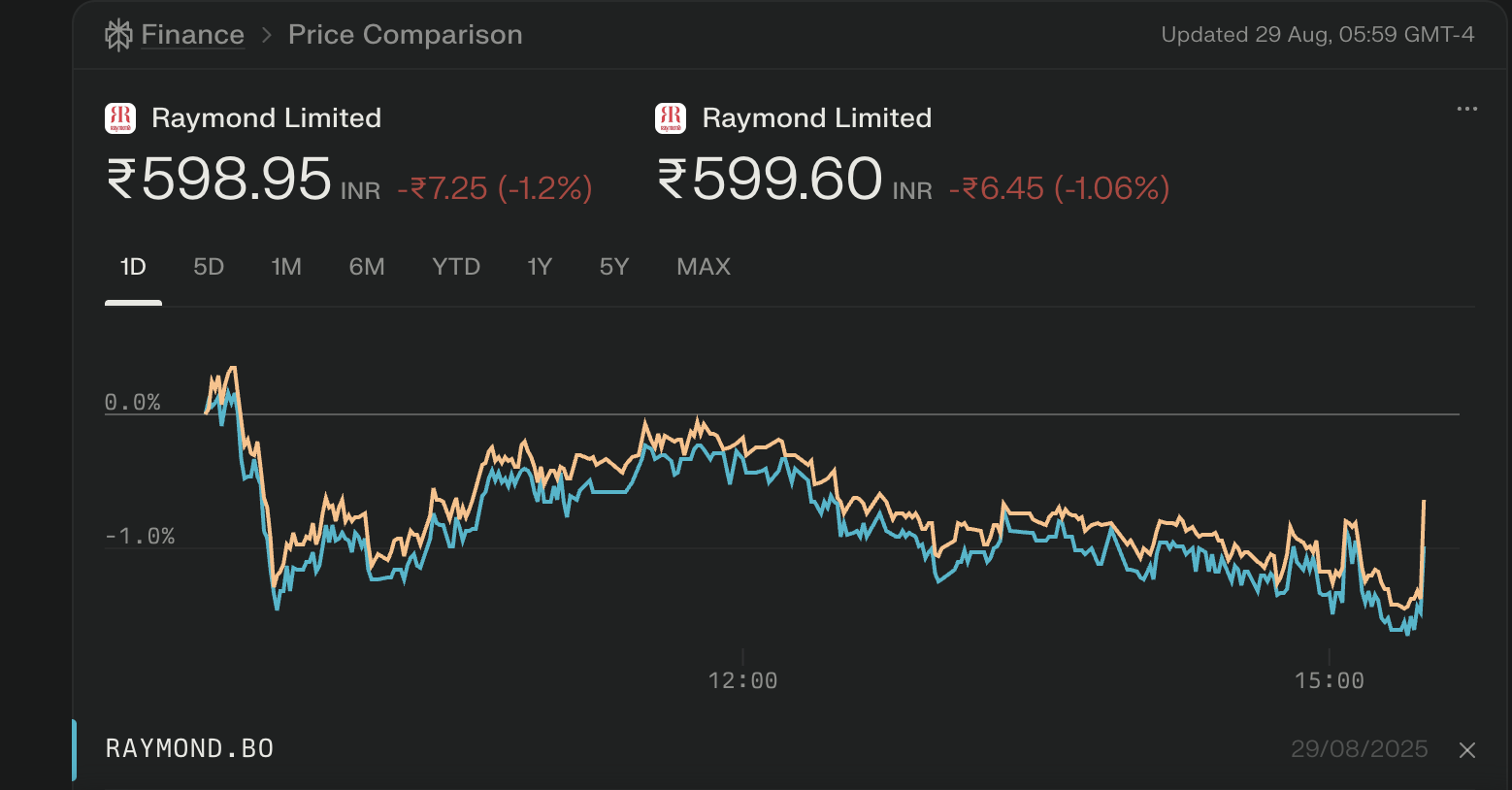

Raymond Stock Price Raymond’s latest price move was driven by its June 2025 quarter results, which showed a sharp year-on-year decline in profits and sales—even as earnings per share (EPS) hit a record. Key Earnings Figures (June 2025 Quarter) Market Impact The steep decline in recurring sales and profit figures—despite a headline EPS boost—led investors…

-

Raymond stock has faced significant challenges in 2025, with poor sales growth, a sharp price decline, and mixed analyst opinions about its future prospects. Current Performance Key Pros & Cons Pros Cons Analyst Recommendations Peer Comparison Name Price (₹) 1Y Return (%) P/E ROCE (%) Market Cap (Cr) Raymond 599.60 -69.85 36.6 1.64 3,992 DLF…

-

HBL Engineering achieved its 5-year CAGR outperformance through strategic expansion in electronics, innovation in railway safety systems, and strong profitability, setting it apart from traditional battery-focused peers. Key Growth Drivers Strategic Outlook HBL’s strategy emphasizes volume growth in electronics and drive trains, ongoing innovation in defense and aviation batteries, and continuous engagement with high-margin infrastructure…

-

Investing in stock futures requires a careful blend of market knowledge, technical analysis, and understanding of company fundamentals. Vodafone Idea Limited, one of India’s prominent telecom players, provides an intriguing case study for investors eyeing stock futures. This article explores Vodafone Idea’s stock futures from an investor’s perspective, evaluating current trends, forecasts, risks, and strategic…

-

Axis Gold ETF – Growth is a gold exchange-traded fund offered by Axis Mutual Fund. It primarily aims to generate returns in line with the performance of gold prices, making it a good investment choice for those looking to gain exposure to gold without physically buying it. Key Features & Performance: Investment Idea: Investing in…