Category: Business

-

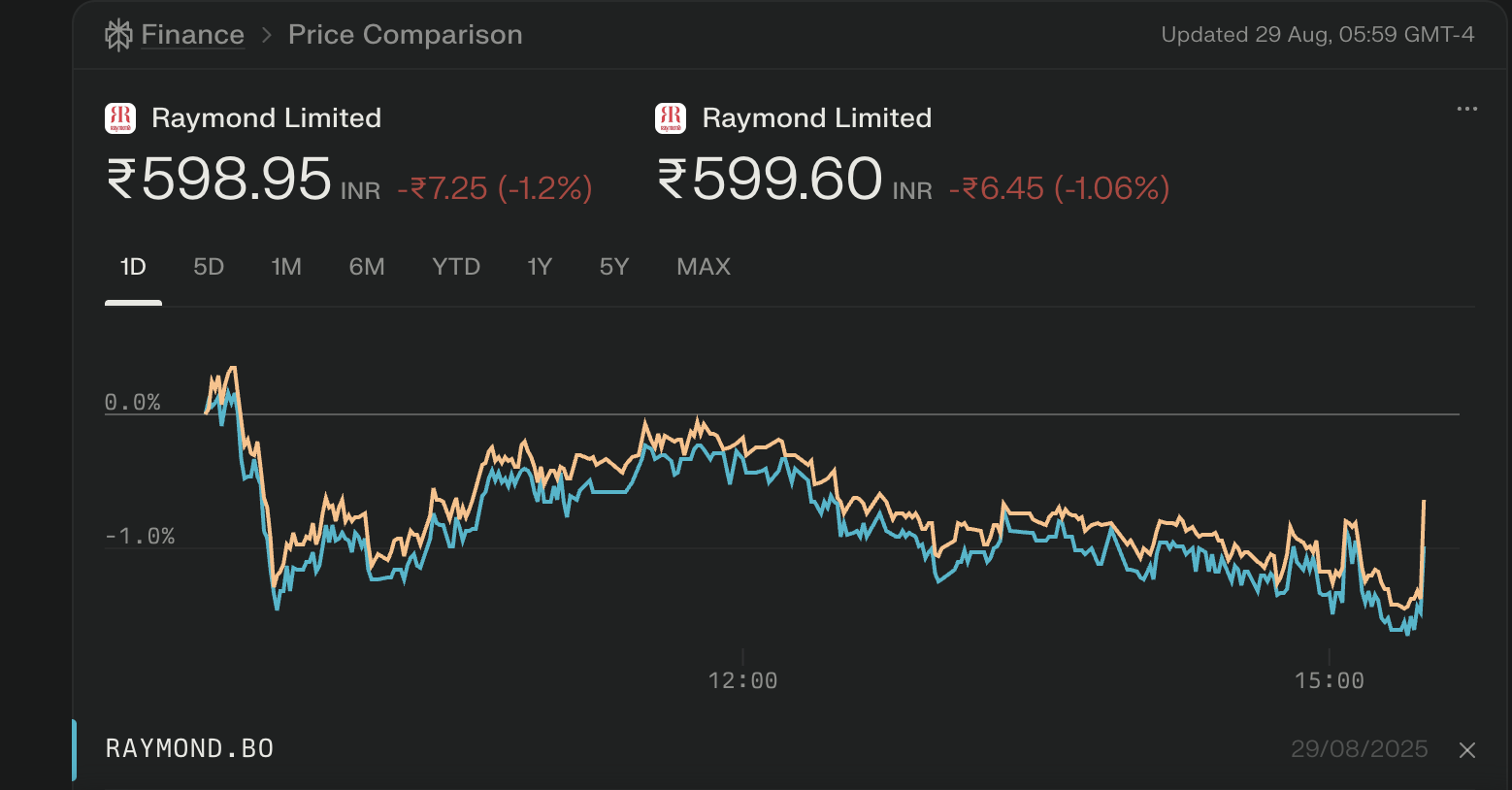

Raymond stock has faced significant challenges in 2025, with poor sales growth, a sharp price decline, and mixed analyst opinions about its future prospects. Current Performance Key Pros & Cons Pros Cons Analyst Recommendations Peer Comparison Name Price (₹) 1Y Return (%) P/E ROCE (%) Market Cap (Cr) Raymond 599.60 -69.85 36.6 1.64 3,992 DLF…

-

HBL Engineering achieved its 5-year CAGR outperformance through strategic expansion in electronics, innovation in railway safety systems, and strong profitability, setting it apart from traditional battery-focused peers. Key Growth Drivers Strategic Outlook HBL’s strategy emphasizes volume growth in electronics and drive trains, ongoing innovation in defense and aviation batteries, and continuous engagement with high-margin infrastructure…

-

Here is a detailed overview of government support scenarios for the Indian telecom companies and this sector in 2025: Government Support Scenarios for Telcos in India Summary The Indian government is actively supporting the telecom sector through direct financial aid, policy reforms, investment incentives, and infrastructure initiatives to help telcos tackle financial pressures, accelerate technology…

-

Regulatory risks for telecom futures, especially in India in 2025, are significant and multifaceted. These risks arise from evolving government policies, regulatory frameworks, licensing requirements, and compliance obligations that telecom companies must navigate. Here are the key regulatory risks impacting telecom futures investments: 1. Policy and Licensing Changes: India’s National Telecom Policy 2025 (NTP-25) introduces…

-

Investing in stock futures requires a careful blend of market knowledge, technical analysis, and understanding of company fundamentals. Vodafone Idea Limited, one of India’s prominent telecom players, provides an intriguing case study for investors eyeing stock futures. This article explores Vodafone Idea’s stock futures from an investor’s perspective, evaluating current trends, forecasts, risks, and strategic…