-

Introduction EPS (Earnings Per Share) and PAT (Profit After Tax) are closely related metrics, but they serve different purposes in gauging a company’s financial health. PAT forms the basis for calculating EPS, and any change in PAT tends to directly influence EPS—provided the number of shares remains unchanged. What is PAT and EPS? The Direct…

-

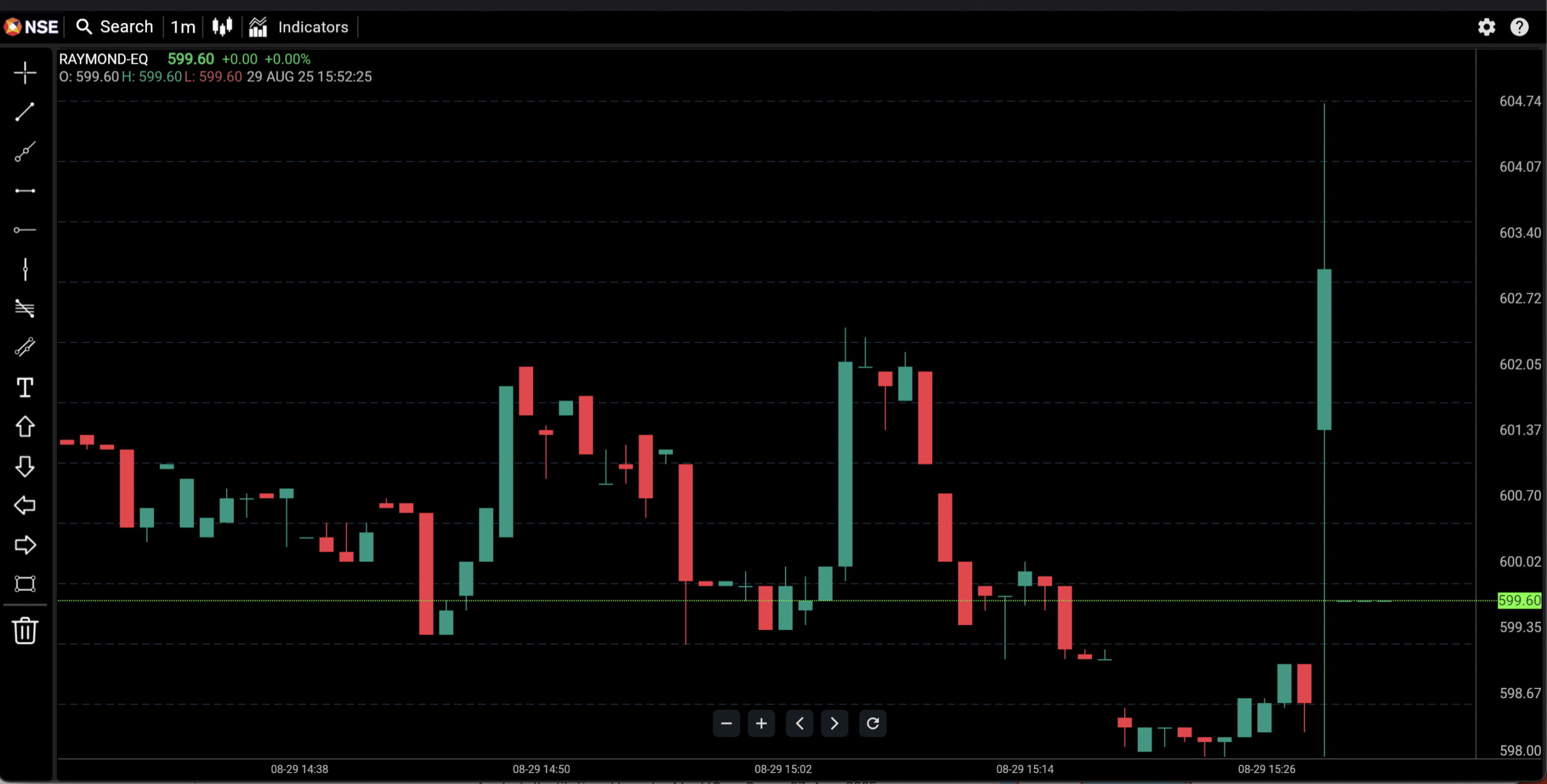

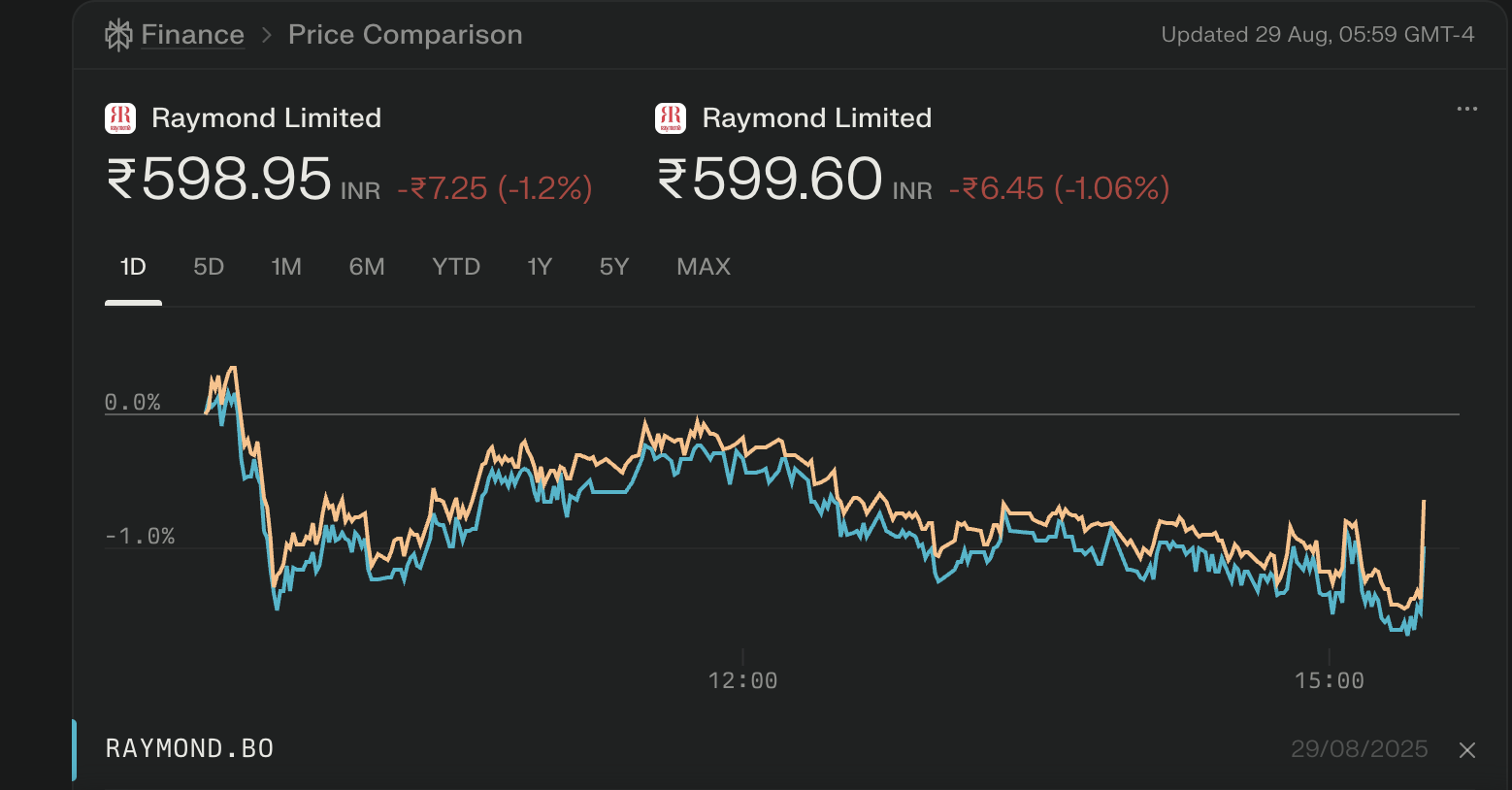

Raymond Stock Price Raymond’s latest price move was driven by its June 2025 quarter results, which showed a sharp year-on-year decline in profits and sales—even as earnings per share (EPS) hit a record. Key Earnings Figures (June 2025 Quarter) Market Impact The steep decline in recurring sales and profit figures—despite a headline EPS boost—led investors…

-

Raymond stock has faced significant challenges in 2025, with poor sales growth, a sharp price decline, and mixed analyst opinions about its future prospects. Current Performance Key Pros & Cons Pros Cons Analyst Recommendations Peer Comparison Name Price (₹) 1Y Return (%) P/E ROCE (%) Market Cap (Cr) Raymond 599.60 -69.85 36.6 1.64 3,992 DLF…

-

Yes, the large Kavach contracts have materially boosted HBL Engineering’s 5-year CAGR by significantly increasing its revenue visibility and order backlog. HBL Engineering secured a series of high-value Kavach orders in 2024-2025 totaling over ₹3,700 crore from various Indian Railway zones. These contracts cover the deployment and upgrade of the Kavach automatic train protection system…

-

HBL Engineering achieved its 5-year CAGR outperformance through strategic expansion in electronics, innovation in railway safety systems, and strong profitability, setting it apart from traditional battery-focused peers. Key Growth Drivers Strategic Outlook HBL’s strategy emphasizes volume growth in electronics and drive trains, ongoing innovation in defense and aviation batteries, and continuous engagement with high-margin infrastructure…

-

Investing in stock futures requires a careful blend of market knowledge, technical analysis, and understanding of company fundamentals. Vodafone Idea Limited, one of India’s prominent telecom players, provides an intriguing case study for investors eyeing stock futures. This article explores Vodafone Idea’s stock futures from an investor’s perspective, evaluating current trends, forecasts, risks, and strategic…

-

Here is a detailed overview of government support scenarios for the Indian telecom companies and this sector in 2025: Government Support Scenarios for Telcos in India Summary The Indian government is actively supporting the telecom sector through direct financial aid, policy reforms, investment incentives, and infrastructure initiatives to help telcos tackle financial pressures, accelerate technology…

-

In the world of investments, risk and return share an intrinsic relationship: higher potential returns typically come with higher risks, while safer investments generally offer lower returns. This trade-off forms the cornerstone of investment strategy, requiring investors to carefully balance their desire for growth with their tolerance for uncertainty. And time in the market plays…

-

Building long-term wealth in India’s dynamic market requires more than just picking stocks or timing trends. Thus, investors typically aim to manage risk and returns through a disciplined approach that includes asset allocation, diversification, and rebalancing. Let’s understand these concepts. Why These Strategies Matter for Indian Investors? The Nifty 50 has historically delivered an average…

-

Regulatory risks for telecom futures, especially in India in 2025, are significant and multifaceted. These risks arise from evolving government policies, regulatory frameworks, licensing requirements, and compliance obligations that telecom companies must navigate. Here are the key regulatory risks impacting telecom futures investments: 1. Policy and Licensing Changes: India’s National Telecom Policy 2025 (NTP-25) introduces…