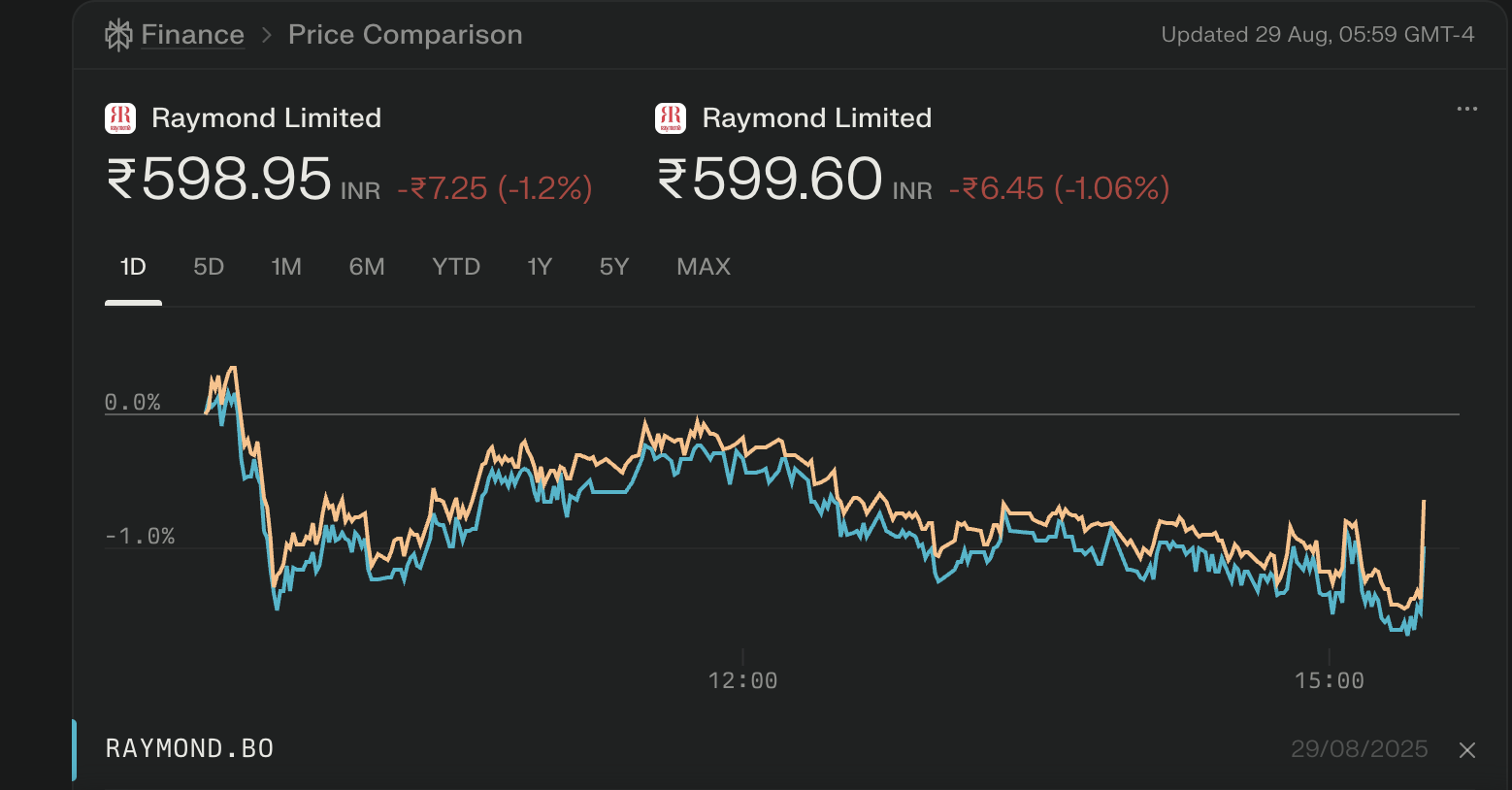

Raymond stock has faced significant challenges in 2025, with poor sales growth, a sharp price decline, and mixed analyst opinions about its future prospects.

Current Performance

- Share price is around ₹599.60 as of August 2025, down about 69.85% over the past year and 53.64% over the past six months.

- The company’s consolidated June 2025 net sales dropped 44% year-on-year.

- Return on equity remains low (5.96% over the last 3 years).

Key Pros & Cons

Pros

- Debt reduction: Raymond has made efforts to reduce its overall debt.

- Stock is trading at almost its book value (P/B ratio ~1) and may be attractive for value-focused investors.

- Some analysts expect future quarterly improvements, possibly driven by automation and aerospace ventures.

Cons

- Poor long-term sales growth: Compounded 5-year sales and profit growth have been negative (-21% and -32%, respectively).

- Recent sharp contraction in revenue and profits.

- Daily technical analysis signals potential for further short-term declines due to bearish momentum.

- Dividend payout is low at just 2.61% of profits over the last three years.

Analyst Recommendations

- One major brokerage (Motilal Oswal) has a strong buy recommendation, with a long-term target up to ₹3,000, but the average analyst score remains mixed due to fundamental concerns.

- Technical forecasts place price targets around ₹903 for 2026, but uncertainty persists about reaching prior highs.

Peer Comparison

| Name | Price (₹) | 1Y Return (%) | P/E | ROCE (%) | Market Cap (Cr) |

|---|---|---|---|---|---|

| Raymond | 599.60 | -69.85 | 36.6 | 1.64 | 3,992 |

| DLF | 739.05 | +99.41 | 43.21 | 6.51 | 182,938 |

| Lodha Developers | 1192.30 | +22.67 | 40.16 | 15.62 | 119,035 |

Summary

Raymond stock in 2025 shows weak sales growth and profitability with declining prices and low dividend payout, but some value traits and analyst optimism remain for potential long-term recovery. Recent performance favors caution, and close monitoring of quarterly results and sector trends is recommended for prospective investors.

Leave a Reply